沃尔特·施洛斯的投资智慧

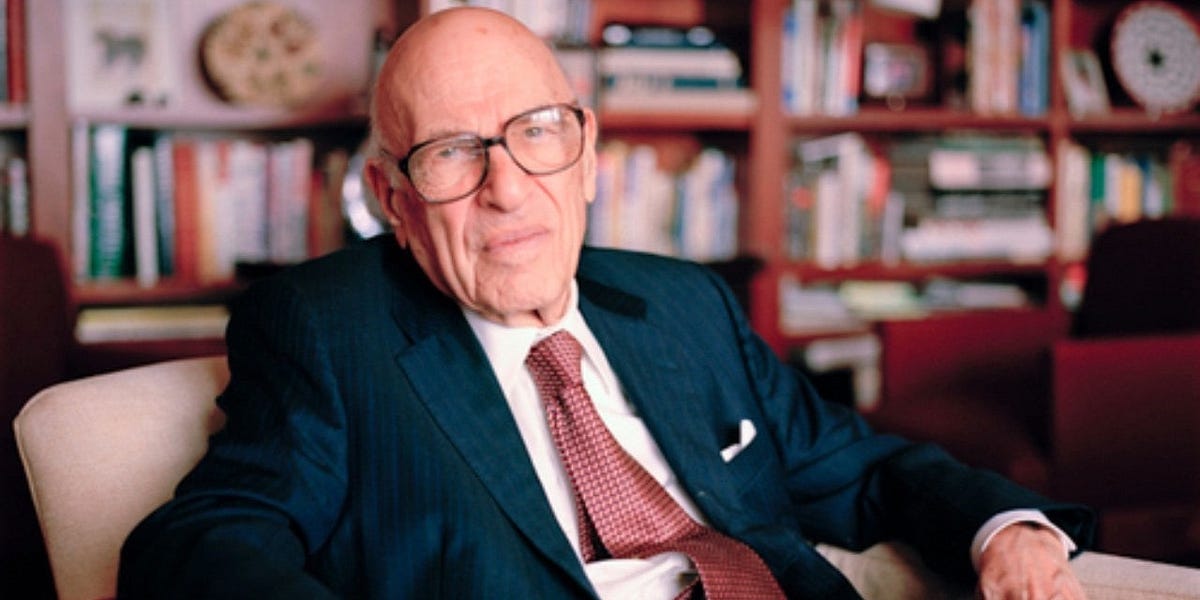

沃尔特·施洛斯是谁?

沃尔特·施洛斯(Walter Schloss)是知名的美国投资者,被誉为价值投资领域的传奇人物之一。他于1916年生于纽约市,2012年去世。

施洛斯以其坚持价值投资原则和长期投资风格而闻名。他是本杰明·格雷厄姆(Benjamin Graham)的学生,格雷厄姆是价值投资理论的奠基人之一。施洛斯在格雷厄姆的投资公司Graham-Newman Corp.工作过,后来在1945年成立了他自己的投资公司——Walter J. Schloss Associates。

施洛斯的投资方法主要侧重于寻找低估值的股票,并持有它们长期投资。他通常会选择那些有稳定盈利能力、低市盈率和良好财务状况的公司。施洛斯以其耐心和坚定的价值投资策略在投资界取得了较好的成绩。

施洛斯的投资风格也受到了巴菲特(Warren Buffett)的赞赏和尊重。在2006年的致伯克希尔股东信中,巴菲特曾特别提到沃尔特,称他是“华尔街最优秀的人物之一”。在巴菲特看来,沃尔特的投资原则之一是“不会冒真正的风险,也就是永久资本损失。”

施洛斯一生经历过18次经济衰退,但他执掌的基金在近50年的漫长时间里长期跑赢标杆股指;他曾得到“价值投资之父”本·格雷厄姆的亲传;他长期坚守简单的价值投资原则,在九十岁高龄时仍保持着高度机敏的投资嗅觉。

尽管沃尔特·施洛斯已经去世,但他的投资哲学和方法仍然对众多投资者产生着启发和影响。

股市中赚钱的因素

沃尔特和埃德温·施洛斯合伙公司(Walter & Edwin Schloss Associates, L.P.)于1994年3月10日在纽约市(NEW YORK, NY 10017)发布了一份关于股票投资的报告,主题是在股市中赚钱所需的因素。以下是原文及翻译。

- Price is the most important factor to use in relation to value.

价格是与价值相关的最重要因素。

- Try to establish the value of the company. Remember that a share of stock represents a part of a business and is not just a piece of paper

尝试确定公司的价值。请记住,一股股票代表着企业的一部分,而不仅仅是一张纸。

- Use book value as a starting point to try and establish the value of the enterprise.Be sure that debt does not equal 100% of the equity. (Capital and surplus for the common stock).

使用账面价值作为起点,尝试确定企业的价值。确保负债不等于股权的100%(普通股的资本和盈余)。

- Have patience. Stocks don’t go up immediately.

要有耐心。股票不会立即上涨。

- Don’t buy on tips or for a quick move. Let the professionals do that,. if they can. Don’t sell on bad news.

不要根据消息或追求快速交易而购买股票。让专业人士去做,如果他们能够做到的话。不要因为坏消息而抛售股票。

- Don’t be afraid to be a loner but be sure that you are correct in your judgment. You can’t be 100% certain but try to look for k weaknesses in your thinking. Buy on a scale and sell on a scale up.

不要害怕独自行动,但确保你的判断是正确的。你不可能百分之百确定,但要试着寻找你思考的弱点。分批购买,逐步卖出。

- Have the courage of your convictions once you have made a decision.

在做出决定后要有坚定的信念。

- Have a philosophy of investment and try to follow it. The above is a way that I’ve found successful.

拥有一种投资哲学,并尽量遵循它。上述方法是我发现成功的一种方式。

- Don’t be in too much of a hurry to sell. If the stock reaches a price the you think is a fair one, then you can sell but often because a stock goes up say 50%, people say sell it and button up your profit. Before selling try to reevaluate the company again and see where the stock sells in relation to its book value. Be aware of the level of the stock market. Are yields low and P-E ratios high. If the stock market historically high. Are people very optimistic etc?

不要急于出售股票。如果股票达到你认为合理的价格,那么你可以出售,但通常情况下,当股票上涨了50%时,人们会建议卖出并锁定利润。在出售之前,尽量重新评估公司,并看看股票的售价与其账面价值的关系。要注意股市的水平。收益率是否低而市盈率是否高?股市是否处于历史高位?人们是否非常乐观等等。

- When buying a stock, I find it helpful to buy near the low of the past few years. A stock may go as high as 125 and then decline to 60 and you think it attractive. 3 years before the stock sold at 20 which shows that there is some vulnerability in it.

在购买股票时,我发现靠近过去几年的低点购买是有帮助的。一支股票可能会涨到125,然后下跌到60,你认为这个价格很有吸引力。而在3年前,该股票售价为20,这表明它存在一定的脆弱性。

- Try to buy assets at a discount than to buy earnings. Earnings can change dramatically in a short time. Usually assets change slowly. One has to know much more about a company if one buys earnings.

尽量以折扣价购买资产,而不是购买收益。收益在短时间内可能会发生巨大变化,而资产通常变化较慢。如果购买收益,就需要对一家公司了解更多信息。

- Listen to suggestions from people you respect. This doesn’t mean you have to accept them. Remember it’s your money and generally it is harder to keep money than to make it. Once you lose a lost of money it is herd to make it back.

倾听那些你尊重的人的建议。这并不意味着你必须接受它们。记住,这是你的钱,通常来说,保住钱比赚钱更困难。一旦你损失了大量的钱,要重新赚回来就很困难了。

- Try not to let your emotions affect your judgment. “ear and greed are probably the worst emotions to have in connection with the purchase and sale of stocks.

尽量不要让情绪影响你的判断力。恐惧和贪婪可能是与股票的买卖相关的最糟糕的情绪。

- Remember the work compounding. For example, if you can make 12% a year and reinvest the money back, you will double your money in 6 years, taxes excluded. Remember the rule of 72.Your rate of return into 72 will tell you the number of years to double your money.

记住复利的作用。例如,如果你每年能够获得12%的回报并将资金再投资,你的资金将在6年内翻倍,不包括税收。记住"72法则”。将72除以你的年回报率,得到的结果将告诉你翻倍所需的年数。

- Prefer stocks over bonds. Bonds will limit your gains and inflation will reduce your purchasing power.

更倾向于股票而不是债券。债券会限制你的收益,而通胀会降低你的购买力。

- Be careful of leverage. It can go against you.

小心杠杆操作,它可能对你不利。